All Categories

Featured

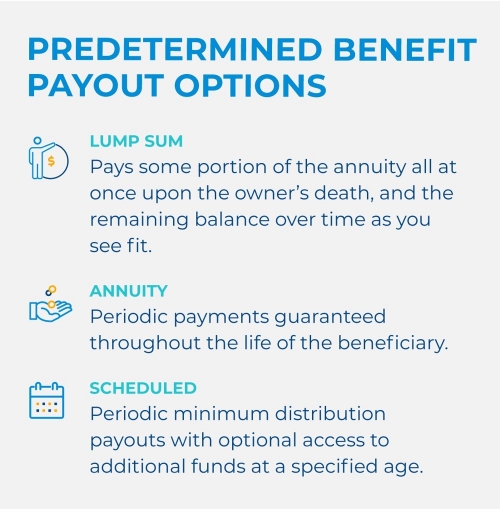

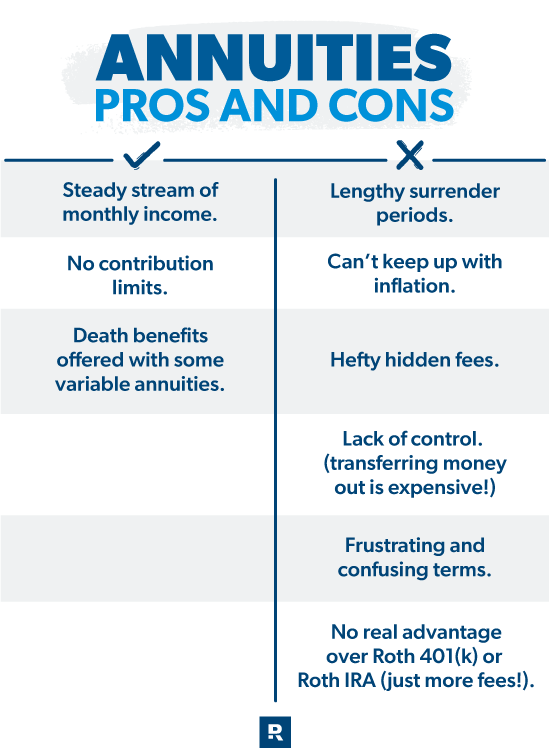

The most effective selection for any person should be based on their present scenarios, tax situation, and economic objectives. Annuity contracts. The cash from an inherited annuity can be paid as a single round figure, which ends up being taxable in the year it is gotten - Annuity cash value. The disadvantage to this alternative is that the incomes in the agreement are distributed initially, which are taxed as normal income

The tax-free principal is not paid until after the revenues are paid out.: The recipient can request that the profits be annuitizedturning the cash into a stream of earnings for a lifetime or a collection time period. The advantage is the repayments are just partly exhausted on the interest section, which means you can postpone tax obligations well into the future.:

Additionally referred to as the Life Expectations or One-year Rule, the nonqualified stretch alternative utilizes the recipients continuing to be life span to compute an annual called for minimum circulation. The list below year, the continuing to be quantity of money is divided by 29, and more. If there are numerous recipients, each one can utilize their very own life expectations to determine minimal circulations. With the stretch alternative, beneficiaries are not restricted to taking the minimal distribution (Annuity contracts). They can take as long as they desire as much as the entire remaining resources. If you don't have an instant requirement for the cash from an inherited annuity, you could choose to roll it into one more annuity you regulate. Via a 1035 exchange, you can route the life insurance firm to move the cash money from your inherited annuity right into a brand-new annuity you establish. By doing this, you remain to postpone tax obligations up until you access the funds, either through withdrawals or annuitization. If the acquired annuity was originally developed inside an individual retirement account, you could trade it for a qualified annuity inside your very own individual retirement account. Acquiring an annuity can be an economic benefit. But, without thoughtful factor to consider for tax

implications, maybe a bust. While it's not possible to totally stay clear of taxes on an acquired annuity, there are numerous means to decrease existing tax obligations while optimizing tax obligation deferment and enhancing the long-lasting value of the annuity. You should not assume that any discussion or details had in this blog site serves as the invoice of, or as an alternative for, personalized financial investment suggestions from DWM. To the extent that a viewers has any concerns concerning the applicability of any kind of certain issue reviewed above to his/her individual circumstance, he/she is motivated to seek advice from the professional expert of his/her choosing. Shawn Plummer, CRPC Retirement Organizer and Insurance Policy Representative: This specific or entity is initially in line to obtain the annuity survivor benefit. Calling a key recipient assists stay clear of the probate process, enabling a quicker and extra direct transfer of assets.: Need to the primary beneficiary predecease the annuity proprietor, the contingent beneficiary will get the advantages.: This choice enables beneficiaries to receive the whole staying worth of the annuity in a single repayment. It gives prompt access to funds however may lead to a significant tax worry.: Beneficiaries can decide to receive the survivor benefitas proceeded annuity payments. This option can provide a consistent income stream and could aid spread out the tax obligation responsibility over numerous years.: Unsure which survivor benefit choice provides the most effective monetary outcome.: Worried regarding the possible tax implications for recipients. Our group has 15 years of experience as an insurance policy company, annuity broker, and retirement planner. We comprehend the anxiety and unpredictability you really feel and are devoted to assisting you locate the best option at the most affordable expenses. Display changes in tax obligation laws and annuity guidelines. Keep your plan current for ongoing peace of mind.: Customized suggestions for your distinct situation.: Complete testimonial of your annuity and recipient options.: Decrease tax responsibilities for your beneficiaries.: Continuous monitoring and updates to your strategy. By not functioning with us, you risk your recipients encountering significant tax obligation burdens and economic problems. You'll really feel positive and comforted, knowing your beneficiaries are well-protected. Get in touch with us today for cost-free guidance or a cost-free annuity quote with boosted fatality advantages. Obtain annuity fatality benefit assistance from a qualified economic professional. This solution is. If the annuitant dies before the payment period, their beneficiary will get the quantity paid right into the strategy or the cash value

Tax implications of inheriting a Period Certain Annuities

whichever is higher. If the annuitant dies after the annuity start day, the beneficiary will usually proceed to receive repayments. The solution to this inquiry depends upon the sort of annuity youhave. If you have a life annuity, your settlements will finish when you pass away. If you have a particular annuity term, your payments will certainly proceed for the specified number of years, also if you die prior to that duration ends. So, it depends on your annuity and what will take place to it when you die. Yes, an annuity can be handed down to heirs. Some policies and policies should be followed to do so. You will certainly need to name a recipient for your annuity. This can be done when you first purchase the annuity or after that. No, annuities normally prevent probate and are not component of an estate. After you pass away, your beneficiaries should call the annuity business to begin getting payments. The company will certainly after that generally send the payments within a couple of weeks. Your recipients will certainly get a swelling sum payment if you have a deferred annuity. There is no collection amount of time for a recipient to assert an annuity.

Annuity recipients can be opposed under certain conditions, such as disputes over the credibility of the beneficiary classification or cases of unnecessary influence. An annuity fatality benefit pays out a set quantity to your recipients when you die. Joint and beneficiary annuities are the 2 types of annuities that can stay clear of probate.

Latest Posts

Highlighting the Key Features of Long-Term Investments Key Insights on Indexed Annuity Vs Fixed Annuity Defining Fixed Vs Variable Annuity Pros Cons Features of Tax Benefits Of Fixed Vs Variable Annui

Understanding Fixed Income Annuity Vs Variable Growth Annuity A Closer Look at Fixed Index Annuity Vs Variable Annuities What Is Fixed Income Annuity Vs Variable Growth Annuity? Features of Variable V

Decoding How Investment Plans Work Key Insights on Immediate Fixed Annuity Vs Variable Annuity Defining Annuity Fixed Vs Variable Pros and Cons of Fixed Index Annuity Vs Variable Annuities Why Fixed I

More

Latest Posts